We offer personalized investment risk advisory and analytical solutions to assist with cross-asset class portfolio risk assessment and calibration to facilitate a disciplined investment process

Your Process...

Your Views...

Your Portfolio...

"The main idea behind complex systems is that the ensemble behaves in ways not predicted by its components. Studying individual ants will almost never give us a clear indication of how the ant colony operates…"

We aim to work with your investment objectives, combine qualitative and quantitative methods to confirm your intended risks, detect exogenous ones, and to have a dialogue with you on what actions can improve your portfolio expressions to achieve the stated return objectives.

We go beyond static reports with numbers and charts to make the most intuitive use of the analysis we produce.

We provide practical hands-on commercial application of investment risk management and close integration with your business processes. We focus on portfolio risk concentrations, market correlations, convexity of returns, and downside tail sensitivities.

With thorough understanding of your unique portfolio risks and investment objectives we devise active ways to help you size your portfolio and mitigate unintended risks. We build a comprehensive stress testing framework to give you an intuitive analysis of your portfolio risks and rewards.

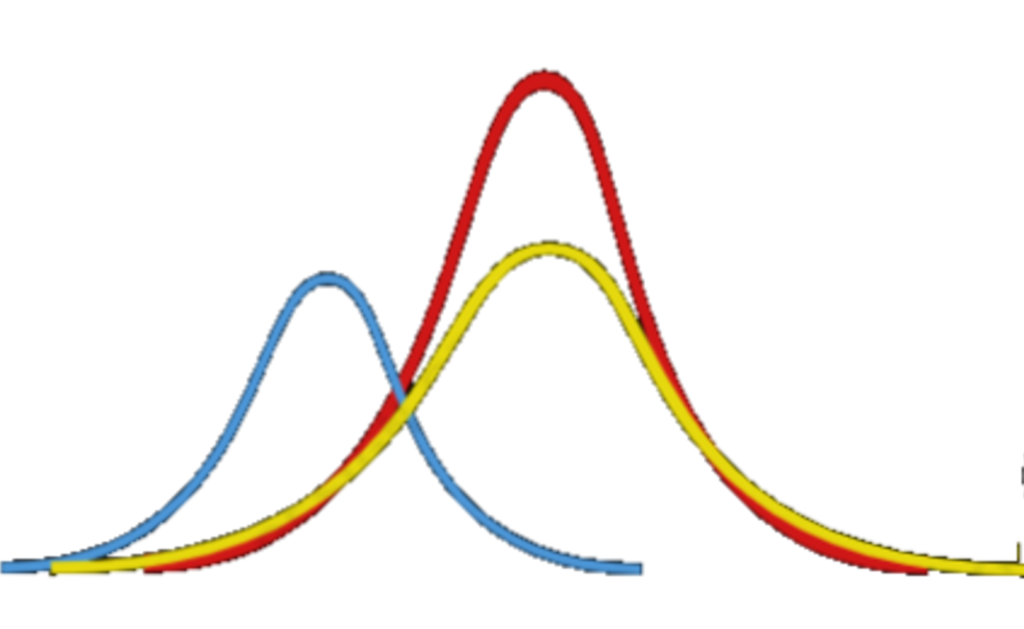

What is Risk in simple terms? It is a potential loss your portfolio can experience and the probability thereof.

With your unique risk tolerance we look at your individual trades, as well as your portfolio in aggregate to measure and discuss if the risks in the portfolio deliver the risk reward ratio you would like to achieve.

Your portfolio risk level awareness is critical in order to make informed decisions in the event that your portfolio exhibits an upward momentum or a drawdown. We help address the complex questions of convexity and market correlations through a discussion of ex-ante and forward looking scenarios and their potential outcomes for your business.