Risk Solutions Service

The more we control our risks, the luckier we get

Early stage funds may choose not to retain an experienced risk team due to budgeting or lack of scope for a full-time responsibility. The function then falls into the hands of the next capable person who carries other duties, which dilutes the efficacy and independence of the risk function.

Engaging with Risk Profile Advisors can bring an experienced team to analyze your portfolio on a regular basis that suits your investment time horizon.

We can establish an analysis of a fund or a portfolio risk profile, perform performance attribution, discuss the current market environment and implications on your portfolio.

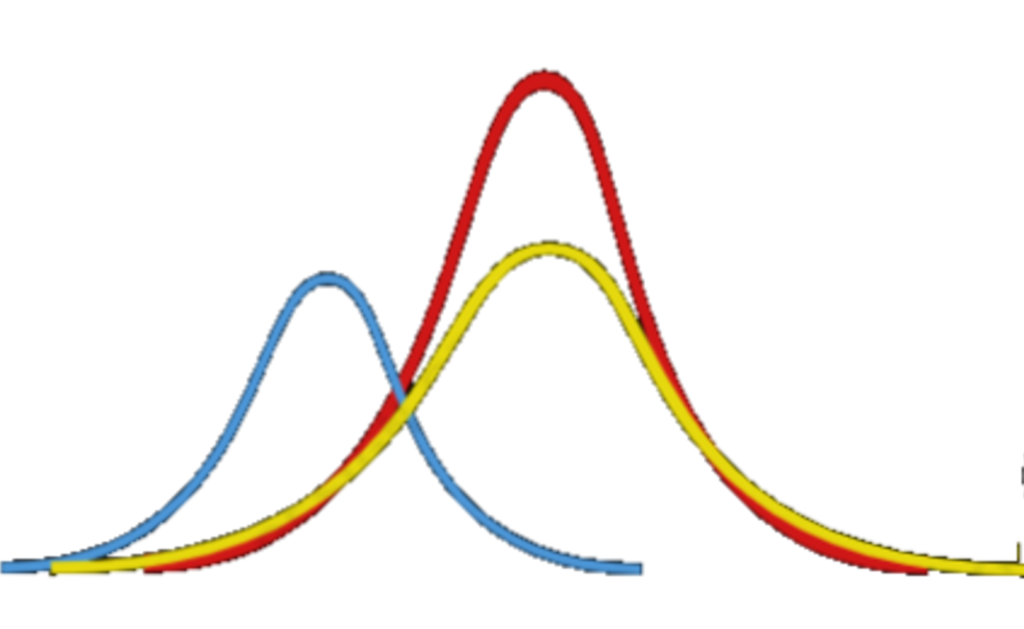

We suggest strategies to help improve risk-adjusted performance and ways to mitigate tail scenarios.

We can help you establish regular communication with your ultimate investors with respect to your portfolio risk profiles, help you write your risk policies and procedures, design reports, and prepare materials for business development.

Investment Process

- Help establish your unique Risk Culture and Framework: portfolio risk levels and procedures around them

- In person risk profile review with members of your investment team on portfolio composition, sensitivities to market dislocations, and potential portfolio calibrations to deliver the desired risk/reward profile.

Portfolio Construction

- Provide advice on your Portfolio Construction for the desired risk objective and identify investment portfolio risk concentrations and tail scenarios

- Assist in establishing a disciplined investment process through targeted portfolio sizing and rebalancing

Risk Analytics

- Develop Custom Risk Reporting: for internal or investor consumption

- Perform portfolio risk slicing based on any degree of freedom your tags allow you

- Risk Analytics that help you improve your portfolio composition and returns based on your investment time horizon

- Analyze the driving factor of returns of your portfolio through the lens of global asset classes

Performance Attribution

- Perform an independent performance attribution of your returns

- Benchmarking of your returns against global markets

- Give you an insight into behavior of illiquid investments

Efficient Communication

- Investor and Regulator communication

- Existing Risk Team training

- Executive Committee/Board Education on sources of up-side and down-side risk in portfolio and how your Risk Framework helps achieve desired investment objectives

Infrastructure

- Help you with your pricing/risk Model validation, calibration and their consistency between different systems/vendors

- Existing risk system review

- Portfolio Management System selection/integration

- Data Organization

- Vendor selection due-diligence